EU Should Limit Curbs on Outbound Investment, Semiconductor Group Says

In the ever-evolving landscape of global technology and trade, the European Union (EU) faces a critical decision on how to manage outbound investments, particularly in the semiconductor industry. As the EU considers imposing restrictions on investments flowing out of its borders, a leading semiconductor group has voiced concerns, urging the bloc to adopt a more measured approach. This article delves into the arguments presented by the semiconductor industry and explores the potential implications of such restrictions.

The Semiconductor Industry’s Stance

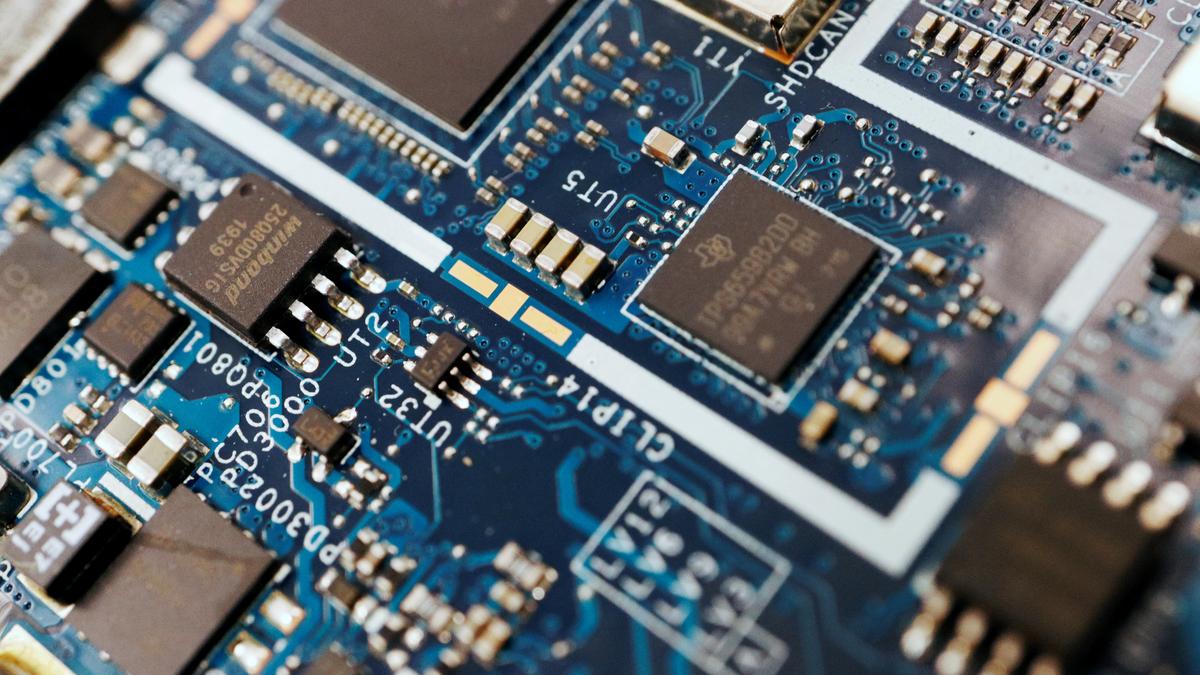

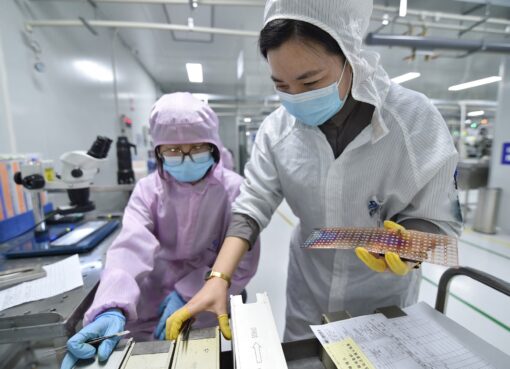

The semiconductor industry, which plays a pivotal role in the global economy, has become a focal point of geopolitical tensions and economic strategies. The industry’s representative bodies argue that excessive restrictions on outbound investments could stifle innovation, disrupt supply chains, and ultimately weaken the EU’s competitive edge in the global market.

Key Arguments Against Restrictive Measures:

- Innovation and Competitiveness: The semiconductor industry thrives on innovation and technological advancements. By imposing stringent curbs on outbound investments, the EU could inadvertently hamper the industry’s ability to invest in research and development (R&D) and collaborate with global partners. This, in turn, could undermine the EU’s position as a leader in semiconductor technology.

- Supply Chain Resilience: The semiconductor supply chain is highly globalized, with different stages of production and assembly spread across various regions. Restricting outbound investments could disrupt these intricate supply chains, leading to delays, increased costs, and potential shortages of critical components. A resilient and diversified supply chain is essential for the stability of the semiconductor industry.

- Market Access and Expansion: For semiconductor companies, outbound investments often serve as a means to access new markets and expand their global footprint. Limiting these investments could restrict the industry’s growth opportunities and hinder its ability to tap into emerging markets, particularly in Asia, where semiconductor demand is rapidly increasing.

- Economic Impact: The semiconductor industry contributes significantly to the EU’s economy, providing high-skilled jobs and driving technological progress. Overly restrictive measures could lead to reduced investment, job losses, and a decline in economic output. Balancing security concerns with economic interests is crucial to maintaining the industry’s vitality.

The EU’s Perspective and Considerations

While the semiconductor industry advocates for a balanced approach, the EU must weigh various factors when formulating its policy on outbound investments. These considerations include national security, technological sovereignty, and economic resilience.

1. National Security: The EU must ensure that outbound investments do not compromise its national security or lead to the transfer of sensitive technologies to rival nations. This is particularly important in the semiconductor sector, where advanced technologies can have dual-use applications with military implications.

2. Technological Sovereignty: As global competition intensifies, the EU aims to bolster its technological sovereignty by reducing dependence on foreign suppliers and strengthening its domestic capabilities. Outbound investment restrictions could be seen as a measure to retain critical technologies within the bloc.

3. Economic Resilience: The COVID-19 pandemic and subsequent supply chain disruptions have highlighted the importance of economic resilience. The EU needs to strike a balance between maintaining open markets and ensuring that its economy can withstand external shocks.

Finding a Balanced Approach

To address the concerns raised by the semiconductor industry while safeguarding its strategic interests, the EU should consider adopting a balanced approach to outbound investment regulations. This approach could include:

- Targeted Restrictions: Instead of blanket restrictions, the EU could implement targeted measures that focus on specific sectors or technologies deemed critical to national security. This would allow for greater flexibility and minimize unintended consequences for the broader economy.

- Enhanced Screening Mechanisms: Strengthening investment screening mechanisms can help identify and mitigate potential risks associated with outbound investments. By conducting thorough assessments, the EU can ensure that investments align with its strategic objectives without imposing overly restrictive measures.

- Public-Private Collaboration: Engaging with industry stakeholders, including semiconductor companies, through consultations and partnerships can provide valuable insights and foster a collaborative approach to policy-making. This can help align regulatory measures with industry needs and ensure a more effective implementation.

- Incentives for Domestic Investment: To encourage domestic investment in critical technologies, the EU could offer incentives such as tax breaks, grants, and R&D funding. This would help boost the competitiveness of the semiconductor industry while reducing reliance on outbound investments.

Conclusion

As the EU navigates the complexities of outbound investment regulations, it must carefully consider the implications for its semiconductor industry. While addressing national security concerns and promoting technological sovereignty are important, striking a balance that fosters innovation, ensures supply chain resilience, and supports economic growth is equally crucial. By adopting a measured and collaborative approach, the EU can safeguard its strategic interests while enabling its semiconductor industry to thrive in the global market.

Leave a Comment